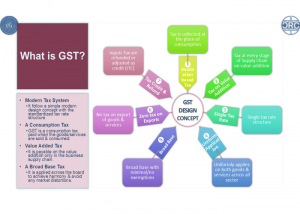

What is GST?

Goods and Services Tax (GST) is a consumption-based tax that is applied to most goods and services in Bhutan. It is charged at a standard rate of 5 percent and is collected at the point where goods or services are consumed. Under GST, the tax burden is borne by the final consumer, while businesses collect the GST and remit to the government on behalf of the consumer. To avoid tax on tax, businesses are allowed to claim back the GST paid on their purchases or import through a mechanism known as Input Tax Credit. This ensures that the tax is levied only on the value added at each stage of the supply chain.

How GST works

- Destination-based: GST is collected where goods or service are consumed, not where it was produced.

- Value-added tax: GST is applicable only on the value added at each stage of the supply chain.

- Consumption Tax: GST is applicable only when goods and services are consumed by consumers.

Who charges and who pays?

- Registered businesses must charge 5% GST on their taxable goods and services , issue invoices, keep records, file returns, and remit the net GST amount to Government.

- Consumers pays GST when they consume goods and services.

- Businesses can claim Input Tax Credit for GST paid on purchase or import for business purposes (e.g., raw materials, equipment, fuel for business vehicles, professional services). GST paid on the Items not meant for business purposes do not qualify for ITC.

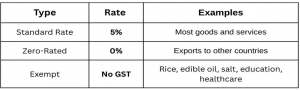

What is taxed—and what isn’t?

- Most goods and services: Taxed at 5%.

- Exports: For the exporters, GST is applicable at the rate of zero% and can claim ITC on the GST paid on their purchases.

- Exempt supplies (no GST charged): Some essential items like rice, edible oil, salt and core public services such as education (schools, colleges, universities) and healthcare (medical treatment, surgeries, dental care).

Note: Cosmetic procedures and private tuition are not exempt.

Why GST?

- Fair and transparent: Tax is paid where goods/services are consumed.

- No tax-on-tax: The input credit system prevents cascading taxes.

- Encourages compliance: Standardized invoicing and filing through the national portal support accurate records and easier audits.

Who Needs to Register for GST?

Businesses must register for GST if they meet certain turnover conditions. Registration ensures that they can charge GST on sales and claim input tax credits on purchases.

Compulsory Registration

- Any business with an annual turnover of Nu. 5 million or more must register for GST.

Turnover is calculated by:

Adding the value of all supplies made in the course of business, plus The value of imported B2B services,

Excluding sale of capital assets and disposal of a business as a going concern.

- For individuals:

The turnover of all businesses owned by the person is combined.

Jointly owned businesses are treated separately and must register if their turnover crosses the threshold. - Voluntary Registration

- Businesses with an annual turnover of Nu. 2.5 million or more but less than Nu. 5 million may choose to register voluntarily.

Conditions:

- The business is engaged in economic activity.

- The Department is satisfied that the business can comply with GST obligations.

Once registered:

- They must remain registered for at least two years (unless allowed otherwise).

- They must comply with all GST rules like compulsory registrants.

Group Registration

Two or more related businesses may apply to register as a GST group if:

- They are controlled by the same person, partnership, or company.

- They meet conditions such as being resident in Bhutan, having the same tax period, and not being in arrears.

- Within a group:

- One member is nominated as the representative.

- All members are jointly responsible for GST payable.

Divisional Registration

A business with multiple divisions may apply for each division to be registered separately if:

- Filing a single return is difficult.

- Each division maintains independent accounts and same tax period

- Divisions operate in different locations or conduct different activities.

Conditions:

- The business is not part of a GST group registration

- The business doesn’t have outstanding tax with DRC.

Note: Divisions remain registered if the combined turnover of all divisions exceeds the registration threshold.

Application Process

- Compulsory registration: Apply within 30 days of crossing the Nu. 5 million threshold.If not, the Department of Revenue & Customs (DRC) may register the business directly.

- Voluntary registration: Applications can be made at any time for turnover between Nu. 2.5 million and Nu. 5 million.

- Applications are made through the Bhutan Integrated Taxation System (BITS) portal.

Department’s Decision

- DRC will notify applicants of its decision within:

15 days (normal applications), or

30 days (divisional registration). - The notice will state:

Effective date of registration if approved, or

Reasons for rejection and the applicant’s right to object.

Cancellation of GST Registration

Businesses may need to cancel their GST registration under certain circumstances. The Department of Revenue & Customs (DRC) oversees the cancellation process.

When to Apply for Cancellation

A registered business must apply for cancellation:

- Within 30 days of permanently ceasing to make taxable supplies.

- If the business is no longer required to be registered but continues to make supplies voluntarily.

Department-Initiated Cancellation

The DRC may cancel registration without an application if it is satisfied that:

- The business is not carrying on any economic activity.

- The business has not maintained proper records, failed to file GST returns, or has not complied with other tax obligations.

- Registration was obtained by providing false or misleading information.

How Cancellation Works

- If the business has been registered for at least 24 months, the Department must cancel the registration.

- If registered for less than 24 months, the Department may cancel the registration if appropriate.

- The cancellation takes effect from the date specified in the notice issued by the Department.

Obligations After Cancellation

Once registration is cancelled, the business must:

- Immediately cease to be a registered person.

- Stop issuing or using any GST invoices or documents that indicate GST

registration. - File a final GST return and pay all amounts due within 30 days from the end of the last tax period.

- Apply for any GST refund, if applicable, within 30 days from the end of the last tax period.

Re-Registration

A previously cancelled business may re-register using the same taxpayer number if it now meets the conditions for GST registration.

Charging GST on Sales

When a business sells goods or services in Bhutan, it is required to charge 5% GST on the value of the supply and collect it from customers. This ensures that the tax is applied fairly and consistently across all taxable transactions.

How to Charge GST – Step by Step

- Determine the Selling Price – First, calculate the base price of your goods or services before GST.

- Add 5% GST – Multiply the selling price by 5% (0.05) to calculate the GST amount.

- Issue a GST Invoice – Provide your customer with a proper GST-compliant invoice. The invoice must clearly state the base price, the GST amount, and the total payable.

- Keep Records – Maintain accurate records of all sales and invoices issued. These records are necessary when filing your GST returns and claiming input tax credits.

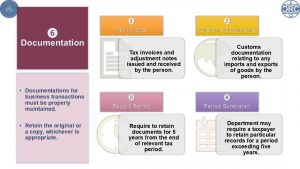

Amending Returns

Every taxable person must file a GST return within 30 days after the end of each tax period.

A person who is not registered for GST but needs to pay GST must file within the period set by the rules.

Amending Returns

To increase the GST amount: can amend within 5 years of the tax period. Late payment and other penalties still apply.

To reduce the GST amount: can amend within 1 year of the tax period.

Self-Assessment

Taxpayers calculate their own GST (self-assessment) and file the return.

The Department may accept this self-assessed GST as final but can check and adjust if needed.

Calculating Net GST

Net GST payable = Total Output Tax – Input Tax Credits + Adjustments

Adjustments can increase or decrease the net amount as allowed by the Act.

Payment of GST

If GST is payable, it must be paid when filing the return unless the Department allows a deferral.

GST on imports must be paid at customs clearance. If goods are not declared,

GST is due when they should have been declared.

The Department may allow collection of GST on imports via postal/courier

services or through authorized agents.

Declarations of Goods

All imported and exported goods must be declared to the Department, whether GST applies or not.

Gifts imported via postal/courier may have GST-free allowances as per the rules. Customs Act provisions apply to GST on imports wherever relevant.

Deferral of Filing and Payment

If you cannot file or pay on time, you may apply for deferral before the due

date. The Department may allow deferral if there’s a valid reason and supporting documents. Late payment penalties will still accrue from the original due date until

payment is made.

How to Claim GST Back (Input Tax Credits)

Registered businesses can reduce their tax burden by claiming back the GST they pay on business-related purchases. This mechanism, known as Input Tax Credit (ITC), ensures that GST is only paid on the final value added at each stage of supply.

What You Can Claim (YES ✅)

Businesses can claim GST paid on:

- Raw materials used in production

- Equipment and machinery

- Office supplies and rent

- Professional and business services

- Fuel for business vehicles

What You Cannot Claim (NO ❌)

GST cannot be claimed on:

- Entertainment or leisure expenses

- Club memberships

- Personal-use vehicles

- Lotteries and similar expenses

How It Works

1. Keep all GST invoices for your business purchases.

2. Calculate the total GST you paid during the month or quarter.

3. Subtract this amount from the GST you collected from customers.

4. Pay only the difference to the government through your GST return.

Input Tax Credits (ITC) – Simplified Guide

1. General Conditions

You can claim an Input Tax Credit (ITC) on GST paid for goods, services, or property if all of the following conditions are met:Purchased for business purposes (economic activity).

Used to make taxable supplies.

Payment has been made for the supply or import.

2. Imported Business-to-Business (B2B) Services

- GST on imported B2B services is paid by the customer.

- You can claim ITC if you account for the output tax correctly.

3. Restrictions on Input Tax Credits

ITC cannot be claimed on:

- Entertainment expenses (unless your business provides entertainment).

- Club memberships or entry fees.

- Lotteries.

- Passenger vehicles or related goods/services (except when part of employee remuneration).

4. Partial Input Tax Credits

If goods, services, or property are used partly for taxable supplies and partly for exempt

supplies, ITC is allowed only for the taxable portion.

- The calculation must follow rules prescribed under the GST Act.

6. Supplies Outside Bhutan

- Goods or services supplied from outside Bhutan are not included in ITC calculations unless they are supplied in Bhutan.

Filing GST Returns

All registered businesses are required to file GST returns regularly. For most businesses, returns must be filed every month within 30 days after the end of the month. Certain businesses, however, may be eligible to file quarterly instead. Filing is done through the BITS portal by logging in and entering sales and purchase details. The system will calculate the net GST due, after which the taxpayer must submit the return and pay any GST owed.

When to File

- Every month: Within 30 days after month-end

- Every quarter: Some businesses can file quarterly

How to File

1. Log into (Bhutan Integrated Taxation System) BITS portal

2. Enter your sales and purchase details

3. Calculate net GST due

4. Submit the return

5. Pay any GST owed

Payments and Refunds

GST payments can be made conveniently online through the BITS portal, via mobile banking apps, or at bank counters. Payments must always be made by the due date to avoid penalties. In cases where a taxpayer has paid more GST than collected, they may request a refund or carry forward the credit to the next period. Special refund provisions are also available for exporters, manufacturers, and businesses that are closing down.

When to Apply for Cancellation

A registered business must apply for cancellation:

- Within 30 days of permanently ceasing to make taxable supplies.

- If the business is no longer required to be registered but continues to make supplies voluntarily.

How to Pay GST

Payments can be made via:

Online portal (BITS)

- GST must be paid by the due date for the tax period.

How to Claim Refund

Refunds of Negative Net Amounts

- If your GST return shows a negative net amount (you paid more GST than collected), you can:

Request a refund in your GST return, or

Carry forward the amount to reduce GST in a future period.

Special rules apply for manufacturers and exporters who often have negative net amounts.

Carry Forward

- Negative net amounts can be used to reduce future GST payments.

- Any unused amount is carried forward until fully used or until the allowed period ends:

- Monthly filers: up to 3 consecutive months

- Quarterly filers: 1 quarter

Refund Without Carry Forward

You can request a refund before carrying forward in certain cases:

- Your registration is cancelled

- You are approved for group/divisional registration

- Your business activities in Bhutan have permanently stopped

- Other special circumstances approved by the Department

Offset Against Outstanding Liabilities

- Refunds are first used to settle any unpaid GST or other dues with the Department.

- Installment arrangements may be allowed if approved.

Penalties

- Late payment or non-payment of GST attracts penalties.

- Pay on time to avoid extra charges.

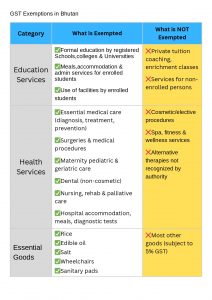

GST Exemptions

Certain goods and services are exempt from GST, meaning no tax is charged on their supply. Among goods, essential items such as rice, edible oil, and salt are GST-exempt. In the case of services, key social sectors are covered under exemption. Education services provided by schools, colleges, and universities, as well as healthcare services such as medical treatment, surgeries, and dental care, are not subject to GST. However, cosmetic procedures and private tuition do not fall under the exemption and will continue to attract GST.

This table provides a comprehensive overview of GST exemptions and non-exemptions in Bhutan across key categories.

Appeal Process

If You Disagree with a GST Decision

If a GST decision affects you, you have the right to object. A taxpayer may submit a written objection to the Department within 30 days of receiving an assessment notice or decision believed to be incorrect or excessive. If the deadline is missed due to reasons beyond your control, the Department may grant an extension. Once an objection is received, independent officers who were not involved in the original decision will review it, and the Department must

accept or reject the objection within 30 days.

If you are not satisfied with the Department’s decision, you may apply to the Review Board within 30 days of the Department’s response or within 60 days if no decision is issued. The application must be made in the prescribed form and accompanied by any required filing fee.

The Review Board will only consider issues raised in your objection unless it allows additional grounds. The burden of proof rests with you to show that the assessment is excessive or that a different decision should have been made. The Review Board will then review the matter and issue its decision.

If you disagree with the Review Board’s decision, you may appeal to the Royal Court of Justice. Such an appeal must be filed within 10 working days of receiving the Review Board’s decision and the reasons provided.

GST Invoice Requirements

A GST invoice is a key document that ensures compliance with tax laws and smooth business operations. Every GST invoice must clearly display the title “TAX INVOICE,” along with the invoice number and date. It should include the business’s name, Taxpayer Identification Number (TPN), and address, as well as a description, quantity, and details of the goods or services supplied. The price breakdown must show the GST-exclusive value, the GST amount, and the total price, with all amounts expressed in Ngultrum (BTN). An invoice that contains all these mandatory details is considered GST-compliant.

GST invoices are important because they allow businesses to claim input tax credits on their purchases and promote transparency in transactions. They also support accurate accounting of GST, helping both taxpayers and the Department ensure proper record-keeping and compliance with the law.